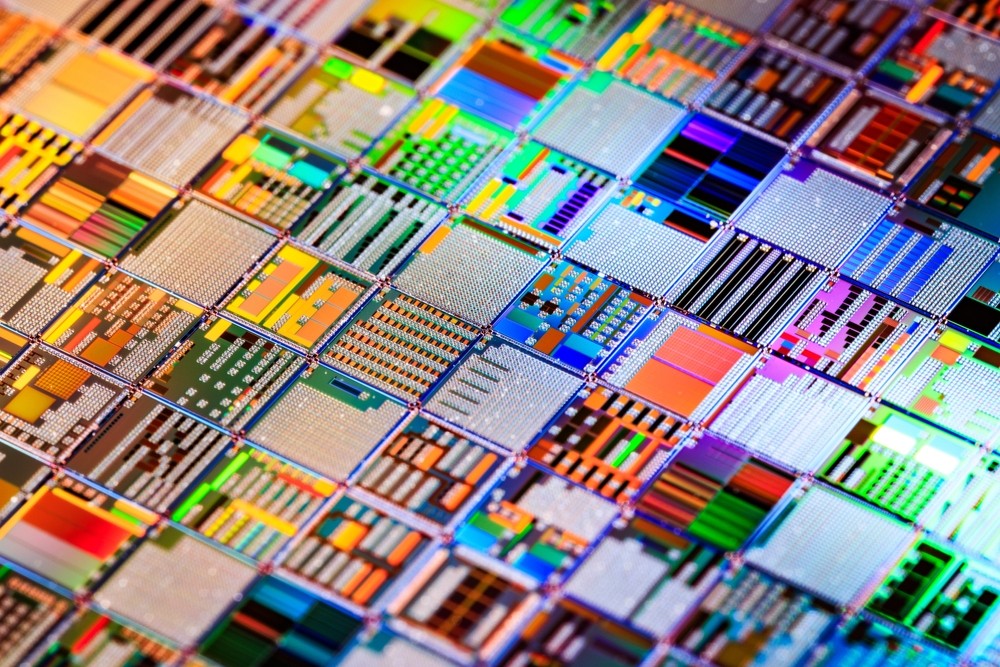

The CHIPS and Science Act represents a groundbreaking moment for the U.S. semiconductor industry. Signed into law in 2022, this legislation allocates billions of dollars to maintain America’s leadership in advanced technologies. For businesses in the semiconductor sector, it’s more than just funding—it’s a once-in-a-generation opportunity to innovate, expand, and position facilities for long-term success.

Do you know how the CHIPS Act impacts semiconductor manufacturing facilities that utilize cleanrooms?

Here’s how you can leverage this opportunity to support your operations. Whether you plan to upgrade an existing facility or build a new cleanroom from the ground up, the time to act is now.

What is the CHIPS and Science Act?

The CHIPS and Science Act was introduced in 2022 to address gaps in the U.S. semiconductor manufacturing ecosystem. The demand for semiconductors was skyrocketing, and global supply chain vulnerabilities were being exposed. As a solution, the Act provides $52.7 billion in federal funding to bolster domestic semiconductor research, development, and production. This initiative is part of a broader strategy to strengthen the nation’s technological infrastructure, support innovation, and ensure long-term economic competitiveness.

What does the CHIPS Act provide:

- $39 billion for manufacturing incentives: This includes funding for facility construction, cleanroom upgrades, and equipment purchases to expand domestic manufacturing capabilities.

- Tax credits for capital expenses: A 25% investment tax credit reduces the financial burden of establishing or upgrading semiconductor manufacturing facilities.

- Guardrails for equitable growth: This will ensure funding is used responsibly, prioritizing projects that create jobs, foster innovation, and exclude facilities in countries of concern.

With its comprehensive funding and strategic initiatives, the CHIPS and Science Act is more than just legislation—it’s a catalyst for transformation, providing semiconductor manufacturers with the tools needed to lead the industry into the future.

How the CHIPS Act Creates Opportunities for Semiconductor Facilities

The CHIPS and Science Act creates long-term opportunities for semiconductor facilities to thrive in a competitive and evolving industry.

What financial incentives does the CHIPS Act provide?

- Tax Credits for Capital Expenses: Facilities can claim a 25% investment tax credit for expenses related to cleanroom construction, advanced equipment, and facility upgrades.

- Grants and Subsidies: The Act provides $39 billion in manufacturing incentives, including direct grants and subsidies, making it easier for companies to expand their production capabilities and build state-of-the-art facilities.

Does the CHIPS Act promote workforce development?

- Investments in STEM Education: Funding is directed toward educational programs at all levels, from K-12 initiatives to advanced degree programs, ensuring a pipeline of talent for semiconductor manufacturing and research roles.

- Creation of Skilled Jobs: The Act supports the creation of tens of thousands of well-paying jobs in construction and ongoing facility operations.

How is the CHIPS Act a catalyst for regional economic development?

- Innovation Hubs Across the U.S.: The Act spurs the development of high-tech innovation hubs that create economic opportunities in underserved regions. It encourages partnerships between local governments, educational institutions, and private businesses.

- Boosting Local Economies: Facility upgrades and new construction projects generate significant local economic activity and benefit small businesses by creating job opportunities beyond the semiconductor industry.

How to Leverage the CHIPS Act Funding to Future-Proof Your Cleanroom Facility

The CHIPS and Science Act allows semiconductor manufacturers to enhance their cleanroom facilities and stay ahead in the industry.

1. Identify Areas for Improvement in Cleanroom Capabilities

Take stock of your facility and identify areas that would benefit from improvement and funding:

- Evaluate whether your existing cleanrooms meet current production demands and ISO standards.

- Identify potential upgrades, such as improving airflow, contamination control, or humidity regulation.

- Pinpoint areas where automation or advanced materials could enhance efficiency and output.

2. Apply for Funding and Tax Incentives to Upgrade or Expand Facilities

The CHIPS Act provides substantial financial support for cleanroom enhancements to reduce the upfront costs of facility improvements:

- Apply for grants or subsidies aimed at modernizing semiconductor manufacturing facilities.

- Leverage the 25% investment tax credit to offset costs associated with new cleanroom construction, equipment purchases, or major renovations.

3. Collaborate with Experienced Partners Like Angstrom for Cleanroom Design and Installation

Building or upgrading a cleanroom requires specialized expertise. Collaborate with experts to minimize risks and ensure your cleanroom meets or exceeds standards:

- Work with a trusted partner like Angstrom to design and install cleanrooms that meet the rigorous demands of semiconductor manufacturing.

- Ensure compliance with ISO standards and industry-specific requirements.

- Benefit from customized solutions tailored to your facility’s unique needs.

4. Invest in Advanced Technologies to Maintain Competitiveness

The semiconductor industry evolves rapidly, making technological innovation a necessity. Staying ahead of technological trends ensures your facility remains competitive in the global market:

- Upgrade your cleanroom with cutting-edge technologies, such as automated monitoring systems, energy-efficient HVAC systems, and modular cleanroom designs.

- Incorporate advanced materials and processes that improve yield rates and reduce contamination risks.

5. Align Facility Upgrades with Long-Term Production Goals

When planning improvements, think beyond immediate needs. Take a strategic approach to facility upgrades to make sure your cleanroom remains a valuable asset for years to come:

- Consider how your facility upgrades can support the production of next-generation semiconductors.

- Ensure scalability so your cleanroom can accommodate increased production capacity as demand grows.

- Align investments with your organization’s long-term vision for innovation and market leadership.

Angstrom Is Here to Help You Leverage the CHIPS Act for Cleanroom Success

The CHIPS and Science Act is a transformative opportunity to strengthen your cleanroom facility. You can enhance your production capabilities and secure your place as a leader in the global market.

With billions of dollars allocated to revitalizing domestic manufacturing, now is the time to act. Upgrade your cleanroom facilities to meet the demands of advanced semiconductor production. Leverage CHIPS Act funding, tax incentives, and grants to future-proof your operations and contribute to the resurgence of American manufacturing.

Ready to take the next step?

Contact Angstrom today to learn how our expert team can help you design and build state-of-the-art cleanroom facilities. Let’s turn opportunity into reality—together.